- Автоматизация

- Антропология

- Археология

- Архитектура

- Биология

- Ботаника

- Бухгалтерия

- Военная наука

- Генетика

- География

- Геология

- Демография

- Деревообработка

- Журналистика

- Зоология

- Изобретательство

- Информатика

- Искусство

- История

- Кинематография

- Компьютеризация

- Косметика

- Кулинария

- Культура

- Лексикология

- Лингвистика

- Литература

- Логика

- Маркетинг

- Математика

- Материаловедение

- Медицина

- Менеджмент

- Металлургия

- Метрология

- Механика

- Музыка

- Науковедение

- Образование

- Охрана Труда

- Педагогика

- Полиграфия

- Политология

- Право

- Предпринимательство

- Приборостроение

- Программирование

- Производство

- Промышленность

- Психология

- Радиосвязь

- Религия

- Риторика

- Социология

- Спорт

- Стандартизация

- Статистика

- Строительство

- Технологии

- Торговля

- Транспорт

- Фармакология

- Физика

- Физиология

- Философия

- Финансы

- Химия

- Хозяйство

- Черчение

- Экология

- Экономика

- Электроника

- Электротехника

- Энергетика

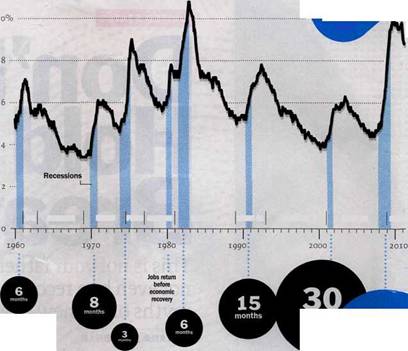

Unemployment rate. JFK JOHNSON NIXON FORD CARTER REAGAN BUSH 41 CUNTON BUSH 43 OBAMA

UNITED STATES I THE ECONOMY

|

Lag between economic recovery and job recovery |

| cushions. Investor money also chased oil prices way up (which hurts the poor most of all) and created bubbles in emerging economies. Now these things are coming back to bite us. All this sounds compUcated, anditis. But it's important to understand that our economy has changed over the past several decades in important and profound ways that politicians at both ends of the spectrum still don't get. There are half a billion middle-class people living abroad who can do our jobs. At the same time, technology has allowed companies to weather the recession almost entirely through job cuts. While Democrats may be downplaying the bad news, Republicans, obsessed with the sideshow that is the debt-ceiling debate, haven't offered a more cohesive explanation for the problems or any real solutions. Rather, both sides continue to push myths about what's happening and how the economy will—or won't—recover. Here are five of the most destructive myths and why we need to figure out a different path to growth. |

2011 growth estimate, locked in before Japan and the oil shock, is still 3. 1%, most economic seers are betting on 2. 6%. That's not nearly enough to propel us out of an unemployment crisis that threatens to create a lost generation of workers who can't find good jobs and may never find them. Welcome to the 2% economy.

While the Administration is taking a sort of " move along, nothing to see here" approach, Republicans are trying to pin every economic problem on Obama in the run-up to the 2012 election. Let's be clear: the slow growth the U. S. is experiencing is not an Obama-specific problem. Many of the ingredients in it were already baked into the economy and were simply laid bare by the financial crisis. According to research by Rogoff and economist Carmen Reinhart, it takes four years after a financial crisis just to get back to the same per capita GDP level you started with, and there's no doubt things would have been dramatically worse had the Administration not taken all the action it did in the wake of the crisis.

But at the same time, the growth problem is Obama's. Every President inherits his predecessor's economy; indeed, it's often what gets him the job. It's then up to the new guy to change the numbers as well as the debate. Now it looks as if Obama is losing that debate. The Republicans have pulled off a major (some would say cynical) miracle by convincing the majority of Americans that the way to jump-start the economy is to slash taxes on the wealthy and on cash-hoarding corporations while cutting benefits for millions of Americans. It's fun-house math that can't work; we'll need both tax increases and sensible entitlement cuts to get back on track. Yet surveys show 50% of Americans think that not raising the debt ceiling is a good idea—that you can somehow starve your way to economic growth.

No wonder the rest of the world is so worried about our future. Sadly, other regions won't be able to help us out, as happened in 2008. Europe is in the middle of its own debt crisis. And emerging markets like China, which helped sustain American companies by buying everything from our heavy machinery to our luxury goods during the recession, are now slamming on the growth brakes. Why? They're worried about inflation, which is partly a result of the Fed's policy of increasing the money supply, known as quantitative easing. Much of that money ended up in stock markets, enriching the upper quarter of the population while the majority has been digging coins out from under couch

Unemployment rate

| 10. 1% inemployment peak, October |

|

JFK JOHNSON NIXON FORD CARTER REAGAN BUSH 41 CUNTON BUSH 43 OBAMA |

|

month |

Compared with that of other slumps since 1960, the current job market has been the slowest to bounce back from losses

Compared with that of other slumps since 1960, the current job market has been the slowest to bounce back from losses

months

(est. )

|

|

|

© helpiks.su При использовании или копировании материалов прямая ссылка на сайт обязательна.

|