- Автоматизация

- Антропология

- Археология

- Архитектура

- Биология

- Ботаника

- Бухгалтерия

- Военная наука

- Генетика

- География

- Геология

- Демография

- Деревообработка

- Журналистика

- Зоология

- Изобретательство

- Информатика

- Искусство

- История

- Кинематография

- Компьютеризация

- Косметика

- Кулинария

- Культура

- Лексикология

- Лингвистика

- Литература

- Логика

- Маркетинг

- Математика

- Материаловедение

- Медицина

- Менеджмент

- Металлургия

- Метрология

- Механика

- Музыка

- Науковедение

- Образование

- Охрана Труда

- Педагогика

- Полиграфия

- Политология

- Право

- Предпринимательство

- Приборостроение

- Программирование

- Производство

- Промышленность

- Психология

- Радиосвязь

- Религия

- Риторика

- Социология

- Спорт

- Стандартизация

- Статистика

- Строительство

- Технологии

- Торговля

- Транспорт

- Фармакология

- Физика

- Физиология

- Философия

- Финансы

- Химия

- Хозяйство

- Черчение

- Экология

- Экономика

- Электроника

- Электротехника

- Энергетика

И.П. Агабекян, П.И. Коваленко 17 страница

• Safety. Credit cards and charge accounts provide a safe and convenient means of carrying our purchasing power with us while we are shopping or travelling.

• Emergency funds. Credit gives us a cushion in an emergency (like an automobile breakdown when money is needed to get back on the road).

Here are some of the disadvantages of buying on credit:

• Overspending. Sometimes, credit cards and chargeaccounts make it too easy to spend money. Then, as the debts mount, it is often difficult to make the necessary monthly payments.

• Higher cost. It usually costs more to buy on credit than for cash. One reason is that stores offering credit often charge more than those that sell only for cash. Another is that interest or other charges are often added to the cost of goods sold on credit.

• Untimely shopping. Credit shoppers often ignore sales and special prices because they can buy what they want on credit whenever they want it.

Who Can Borrow?

Lenders expect their money to be repaid along with the interest and other fees they charge for the use ol their money. For that reason lenders will investigate the credit history of all loan applicants to determine that they are credit worthy. A credit history is the record of how individuals pay their bills and repay loans.

The Three C’s

In judging an individual’s credit worthiness, lenders often look at the «three C’s» of credit: character, capacity and capital.

• Character refers to personal qualities— honesty and willingness to repay debts. If the record shows that bills were paid on time in the past, lenders will assume this will continue in the future.

• Capacity is a measure of the ability to repay debts. Creditors will want to know about the sources of income, how much the person earns and his other financial obligations.

• Capital refers to the things that people own— money in the bank, or property. In general, the more one owns, the easier it will be to repay one’s debts. Lenders may also ask that some capital be offered as collateral, something pledged as security for the loan.

^Text 5 WHAT KINDS OF CREDIT ARE AVAILABLE?

Credit for consumers falls into two categories: loar credit and sales credit.

Loan credit enables you to borrow money which can then be used to finance a purchase. Sales credit enables you to buy goods and services now and pay for them later. Here are some examples of each.

Home mortgages. Home mortgages are long-term loans (repayable in 10 to 30 years) used to finance the purchase of a home or apartment. Banks, savings and loans and other thrift institutions are the most likely sources of mortgage money. Home mortgages are repaid with interest, in equal monthly installments, over the life of the loan.

Auto and other consumer loans. Loans for financing the purchase of specific items like automobiles, or other goods and services, are available from a variety of thrift institutions and lending agencies. Auto and other consumer loans are usually repaid in equal monthly installments over the life of the loan.

Charge accounts. Charge accounts enable consumers to make purchases up to a specified limit, without paying cash. There is usually no charge for the use of a charge account if the balance is paid in full at the end of the month. However, interest is likely, to be charged on balances that are not paid at the end of one month.

Credit cards. A credit card is a kind of charge account that entitles its holders to shop at many different places. Master Card, Visa, American Express and Diner’s Club are four of the most widely used credit cards. Credit card purchases are billed monthly. Like charge accounts, there is usually no charge for credit card purchases that are paid in full when billed. However, there is an additional charge levied on unpaid balances.

<^Text 6 HOW TO ESTABLISH CREDIT

People frequently have difficulty borrowing or buying on credit because they have no credit history. To establish a «credit» people must prove that they are willing and able to handle financial obligations.

They might, for example, open a charge account in a department store or apply for a gasoline credit card. Prompt payment of the bills on these kinds of accounts will help establish a positive credit rating. If persons has a savings account, they may already be eligible to apply for a passbook loan against the balance in that account. Here again, prompt repayment will add to credit rating. If necessary, it is possible to borrow before you have established a credit rating if you can find a co-signer. A co-signer is a person with an acceptable credit rating who guarantees to repay the loan if you are unable to do so. The point is that a good credit rating is a valuable financial tool. While it may take some time to acquire and maintain, it will increase your financial options.

Vocabulary

principal основная сумма finance charges зд. оплата кредита service charges плата за обслуживание annual percentage rate ставка годового процента installments взносы arrangement договоренность

charge accounts кредиты по открытому счету household mortgage жилищная ипотека credit history досье заемщика capacity способность credit worthy кредитоспособный pledged as security for the loan заявленное, как обеспечение займа loan credit and sales credit ссудный кредит и коммерческий кредит consumer loan потребительская ссуда thrift institutions and

lending agencies сберегательные учреждения и кредитные агентства good credit rating хорошая кредитоспособность

^^Задание 5.3. Give answers to the following questions:

1. What is the convenience of consumer credit?

2. What is included in the finance charge?

3. What is APR?

4. What is credit?

5. What are the best known forms of credit?

6. What are the principal advantages of credit ?

7. What are the disadvantages of credit ?

8. What is the credit history?

9. How do lenders decide whether to give or not to give credits?

10. What are the kinds of credit?

11. What credit cards in Russia do you know?

12. What are the most widely used credit cards abroad?

13. What is necessary to establish a credit?

LESSON 6

^Text 1 INFLATION

Inflation is generally defined as a persistent rise in the general price level with no corresponding rise in output, which leads to a corresponding fall in the purchasing power of money.

In this section we shall look briefly at the problems that inflation causes for business and consider whether there are any potential benefits for anicnterprise from an inflationary period.

Inflation varies considerably in its extent and severity. Hence, the consequences for the business community differ according to circumstances. Mild inflation of a few per cent each year may pose few difficulties for business.

However, hyperinflation, which entails enormously high rates of inflation, can create almost insurmountable problems for the government, business, consumers and workers. In post-war Hungary, the cost of hving was published each day and workers were paid daily so as to avoid the value of their earnings falling.

Businesses would have experienced great difficulty in costing and pricing their production while the incentive for people to save would have been removed.

Economists argue at length about the causes of, and «cures» for, inflation. They would, however, recognize that two general types of inflation exist:

• Demand-pull inflation

• Cost-push inflation

Demand-pull Inflation

Demand-pull inflation occurs when demand for a nation’s goods and services outstrips that nation’s ability to supply these goods and services. This causes prices to rise generally as a means of limiting demand to the available supply.

An alternative way that we can look at this type of inflation is to say that it occurs when injections exceed withdrawals and the economy is already stretched (i.e. little available labour or factory space) and there is little scope to increase further its level of activity.

Cost-push Inflation

Alternatively, inflation can be of the cost-push variety. This takes place when firms face increasing costs. This could be caused by an increase in wages, the rising costs of imported raw materials and components or companies pushing up prices in order to improve their profit margins.

Vocabulary

a persistent rise неуклонный, постоянный подъем with no corresponding rise in output не сопровождающийся подъемом производства briefly коротко, кратко potential benefits потенциальные выгоды varies considerably in its extent and severity бывает разной по длительности и остроте hence следовательно mild inflation мягкая, низкая инфляция may pose few difficulties

особых проблем не представляет entails enormously iiigh rates of inflation влечет за собой громадный рост инфляции insurmountable неисчислимые, колоссальные at length и сейчас to pull тянуть demand-pull inflation инфляция спроса, вызванная превышением спроса над предложением

cost-push inflation инфля- little available labour мало ция издержек, вызванная рабочей силы

ростом издержек произ- there is little scope мало воз- водства можностей

to occur происходить in order to improve their

to outstrip обгонять, опере- . -

r profit margins чтобы уве-

жать, превосходить r

to stretch натягивать, на- личить прибыль (размеры прягать прибыли)

Задание 6.1. Give Russian equivalents for the following:

1. inflation varies considerably in its extent and severity;

2. mild inflation of a few %;

3. rate of inflation;

4. insurmountable problems;

5. demand-pull (cost-push) inflation;

6. the economy is already stretched.

Задание 6.2. Find the synonyms to the words in italics: a persistent rise; may pose few difficulties; which entails enormously high rates; at length, inflation occurs when; little scope to increase its level of activity; firms face increasing costs.

^^Задание 6.3. Find in the text English equivalents for the following:

1. повышение (падение) спроса (покупательной способности) и т. д.;

2. гиперинфляция;

3. запросы опережают возможности экономики;

4. предложить товары и услуги;

5. уровень прибыли.

Задание 6.4. Translate into English:

Следует отличать инфляцию спроса от инфляции, обусловленной ростом издержек. Суть инфляции спроса иногда объясняют одной фразой: «Слишком много денег охотятся за слишком малым количеством товаров». Теория инфляции, обусловленной ростом издержек, объясняет рост цен такими факторами, которые приводят к увеличению издержек на единицу продукции.

^Text 2 INFLATION AND BUSINESS

Inflation can adversely affect business in a number of ways:

1. Accounting and financial problems.

Significant rates of inflation can cause accounting and financial problems for businesses. They may experience difficulty in valuing assets and stocks, for example. Such problems can waste valuable management time and make forecasting, comparisons and financial control more onerous.

2. Falling sales.

Many businesses may experience falling sales during inflationary periods for two broad reasons. Firstly, it may be that saving rises in a time of inflation. We would expect people to spend more of their money when prices are rising to avoid holding an asset (cash), which is falling in value. However, during the mid-1970s, when industrialized nations were experiencing high inflation rates, savings as a proportion of income rose! It is not easy to identify the reason for this, but some economists suggest that people like to hold a relatively high proportion of their assets in a form which can tie quickly converted into cash when the future is uncertain.

Whatever the reason, if people save more they spend less and businesses suffer falling sales. The economic model predicts that if savings rose the level of activity in the economy would fall. Clearly, if this happened we would expect businesses to experience difficulty in maintaining their levels of sales.

Businesses may be hit by a reduction in sales during a time of inflation for a second reason. As inflation progresses, it is likely tliat workers’ money wages (that is, wages unadjusted for inflation,) will be increased broadly in line with inflation. This may well take a worker into a higher tax bracket and result in a higher percentage of his or her wages being taken as tax. This process, known as fiscal drag, will cause workers to have less money available to spend on firms’ goods and services. The poverty trap has a similar impact. As money wages rise, the poor may find that they no longer qualify for state benefits to supplement their incomes and at the same time they begin to pay income tax on their earnings. Again, this leaves less disposable income to spend on the output of firms. Finally, it may be that the wages of many groups are not index-linked and so they rise less quickly than the rate of inflation, causing a reduction in spending power and demand for goods and services.

Once again, the economic model can be used to predict that increases in the level of taxation will increase withdrawals, lowering the level of economic activity and depressing firms’ sales.

Not all businesses will suffer equally from declining demand in an inflationary period. Those selling essential items, such as food, may be little affected whilst others supplying less essential goods and services, such as foreign holidays, may be hard hit.

3. High interest rates.

Inflation is often accompanied by high interest rates.

High interest rates tend to discourage investment by businesses as they increase the cost of borrowing funds. Thus, investment may fall. Businesses may also be dissuaded from undertaking investment programmes because of a lack of confidence in the future stability and prosperity of the economy. This fall in investment may be worsened by foreign investment being reduced as they also lose some confidence in the economy’s future.

Such a decline in the level of investment can lead to businesses having to retain obsolete, inefficient and expensive means of production and cause a loss of international competitiveness. Finally, a fall in investment can lower the level of economic activity, causing lower sales, output and so on. Thus, to some extent, businesses can influence the economic environment in which they operate.

4. Higher costs.

During a bout of inflation firms will face higher costs for the resources they need to carry on their business. They will have to pay higher wages to their employees to compensate them for rising prices. Supplies of raw materials and fuel will become more expensive as will rents and rates. The inevitable reaction to this is that the firm has to raise its own prices. This will lead to further demands for higher wages as is called the wage- price spiral. Such cost-push inflation may make the goods and services produced by that enterprise internationally less competitive in terms of price. An economy whose relative or comparative rate of inflation is high may find that it is unable to compete in home or foreign markets because its products are expensive. The economic model tells us that a situation of declining exports and increasing imports will lower the level of activity in the economy with all the consequent side-effects.

354 I Английский для экономистов

Vocabulary

impact удар, влияние, воздействие waste valuable management time может уходить много драгоценного времени make more onerous сделать более затруднительным to avoid holding an asset чтобы избавиться от наличности whatever the reason какова бы ни была причина businesses may be hit by фирмы (предприятия) могут пострадать от... wages unadjusted for inflation заработная плата без учета уровня инфляции a higher tax bracket следующая категория при группировке налогоплательщиков по доходу fiscal drag финансовый тормоз экономического роста с помощью налоговых изъятий they по longer qualify for они больше не подпадают под... to supplement their incomes что является дополнением к их доходу this leaves less disposable income из-за этого остается меньше средств

index-linked индексированный

a reduction in spending

power снижение покупательной способности declining demand падение спроса

tend to discourage investment не способствуют инвестированию may also be dissuaded from могут также отказаться от...

a lack of confidence недостаток (отсутствие) уверенности

this fall in investment may be worsened by foreign investment being reduced

это падение уровня инвестирования может стать еще сильнее, если сократятся иностранные инвестиции can lead to businesses having to retain может привести к тому, что фирмам (предприятиям) придется сохранить a bout (period, spell) of inflation период инфляции

less competitive in terms of price менее конкурентоспособный в смысле цены

Задание 6.5. Find Russian equivalents to the following word combinations:

1. difficulty in valuing assets and stocks;

2. to avoid holding an asset;

3. wages unadjusted for inflation;

4. increased in line with inflation;

5. this may well take a worker into a higher tax bracket;

6. fiscal drag;

7. poverty trap;

8. wages are not index-linked;

9. spending power;

10. the cost of borrowing funds;

11. the wage-price spiral;

12. in terms of price.

Задание 6.6. Find synonyms for the words in italics: broad reasons;

to identify the reason for this;

businesses may be hit by a reduction in sales;

wages unadjusted for inflation;

will increase withdrawals depressing firms’ sales;

may be dissuaded from undertaking ...

Задание 6.7. Find in the text English equivalents for the following:

1. делать что-либо затруднительным

2. периоды инфляции

3. назвать причину чего-либо

4. превратить в наличные

5. распространяться на кого-либо (о государственных льготах)

6. доход, остающийся после уплаты налогов

7. товары первой необходимости

8. компенсировать кому-либо что-либо

Задание 6.8. Translate into English:

Концепция инфляции спроса предполагает, что если экономика стремится к высокому уровню производства и занятости, то умеренная инфляция необходима. Однако, сторонники концепции инфляции издержек утверждают, что умеренная инфляция, которая может сначала сопутствовать оживлению экономики, потом, нарастая как снежный ком, превратится в более жестокую гиперинфляцию (чрезвычайно быстрые темпы роста инфляции, которая оказывает разрушительное действие на объем национального производства и занятость).

LESSON 7

<^Text 1

ECONOMIC STABILITY AND BUSINESS CYCLES

When people speak of business cycles, they think of things like «prosperity» and «depression.» «Prosperity» is ordinarily used to describe an extended period of high employment, an improved standard of living and stable prices.

By contrast, «depression» refers to an extended period of general underemployment of our economic resources. Factories are idle, millions of workers are unable to find jobs, and the rate of business failure is high. The worst depression in American history, now known as the Great Depression, lasted from 1930 to 1940. There were, for example, 13 million people, about one of every four workers, unemployed in 1933. That same year businesses failed at a record rate, and numbers of people lost their savings because more than 4,000 privately owned banks closed' permanently.

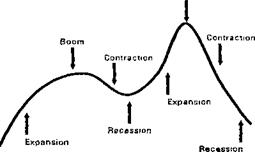

More common, however, are much shorter and less dramatic changes in business activity. These changes can be described in a number of different ways, but for convenience they are called the periods of boom, contraction, recession and expansion. The way to smooth out economic fluctuations was not found yet.

| The Business Cycle Boom

|

Boom

At the peak of the business cycle the economy is booming. Business is producing at or near capacity, and those looking for work can generally find jobs. During peak times, business investment and consumer spending are at very high levels. But because the economy is at or near full employment and the demand for goods and services is increasing, prices are also increasing. This sets the stage for the next phase of the business cycle.

Contraction

For any number of reasons, consumers and businesses begin to reduce their spending levels. Businesses may lay off workers, reduce their purchases of raw materials and reduce production because they have built up excess inventories. Some businesses may decide to continue to use old factories and equipment rather than investing in new machines and buildings. Some businesses and consumers will even reduce spending because economists predict that business will be slowing down in the next few months. Whatever the reason, reductions in business and consumer spending mark the beginning of a contraction in the business cycle.

With the reduction in spending, other business firms begin to cut back their activities. Their production is reduced and more workers are laid off. Because of the layoffs, workers, who are also consumers, spend less. This leads to still more reductions in production and additional worker layoffs.

Recession

With factories operating at less than capacity and unemployment at very high levels, total output of goods and services enters a long-term decline. This is the bottom phase of the business cycle, or as economists describe it, the period of recession.

Times are hard during recessions. Unemployment is very high, jobs are difficult to find and many businesses fail. A very severe and long-lasting recession is called a *depression.»

Expansion

After a period of recession the economy eventually begins to recover, entering the expansion phase of the business cycle. During a period of expansion the conditions are about to improve, business begins to expand its activities. Unemployment declines as additional workers are hired. This, in turn, leads to higher levels of consumer spending and still further expansion of employment, output and consumption.

WHAT CAUSES BUSINESS CYCLES?

For many years economists struggled to find a theory that would explain all business cycles.

In explaining business cycle fluctuations, today’s economists often distinguish between external and internal events. External events are those outside the economic system that explain fluctuations in the business cycle. Internal events are those occurring within the economy itself.

External Causes

External factors affect the economy because of population changes, inventions and innovations, and other significant political and social events.

Population changes. Changes in population affect the demand for goods and services. Population increases can lead to increased production and employment levels that trigger expansion and boom. Population decreases are likely to have the opposite effect.

Inventions and innovations. Major changes in technology, such as the development of the automobile, the airplane and the computer, have led to bursts of business activity and investment. This, in turn, was followed by increased employment opportunities and a period of expansion and boom.

Internal causes

Internal causes of fluctuations are factors within the economy likely to start an expansion or contraction of the business cycle. Three of these internal factors have to do with consumption, business investment, and government activity.

Consumption

Business firms try to provide consumers with the goods and services they want. When consumer spending is on the increase, business firms hire additional help and increase their level of production. As production, employment and sales increase, the business cycle enters a period of expansion and boom. When consumer spending decreases, the opposite occurs. Production is reduced, workers are laid off, and he economy enters a period of contraction and recession.

Business investment

Investment in capital goods like plant, tools and equipment, creates additional jobs, thereby increasing consumer purchasing power. The increase in spending generated by the initial increase in investment leads to still further investment, consumption and total production. When investment decreases, the opposite occurs and the economy enters a period of contraction.

Government activity

Governmental policies can give the business cycle an upward or downward nudge. Government does this in two ways. One is through the use of its power to tax and spend. The other is by regulating the supply of money and credit in circulation. Economists describe government’s ability to tax and spend as its fiscal powers, and its ability to regulate the supply of money and credit as its monetary powers.

Vocabulary

prosperity процветание depression депрессия business failure банкротство economic fluctuations экономические колебания spending levels уровни расходов

excess inventories избыток материальных запасов

contraction сокращение laid off временно уволенный layoffs временные увольнения long-term decline долгосрочное снижение recession спад eventually в конечном счете to recover оправляться expansion расширение

^^Задание 7.1. Answer the questions:

1. What happens during each of the phases of the business cycle?

2. How do we measure business cycles?

3. How does the government try to stabilize the ups and downs of the economy?

|

IMPORT - EXPORT

International trade is the exchange of goods and services between different countries. Depending on what a country produces and needs, it can export (sell goods to another country) and import (buy goods from another country). Governments can control international trade. The most common measures are tariffs (or duties) and quotas. A tariff is a tax on imported goods, and a quota is the maximum quantity of a product allowed into a country during a certain period of time. These measures are protectionist as they raise the price of imported goods to «protect» domestically produced goods.

International organisations such as the WTO (World Trade Organisation) and EFTA (European Free Trade Association) regulate tariffs and reduce trade restrictions between member countries.

Companies can choose from various methods to establish their products in a foreign market. One option is to start by working with local experts such as sole agents or multi-distributors, who have a specialist knowledge of the market and sell on behalf of the company. This often leads to the company opening a local branch or sales office. Another option is to sell, or give permission to use, patents and licences for their products. Companies may wish to start by manufacturing in the export market, in which case they can either set up a local subsidiary or a joint venture with a local partner.

Vocabulary

tariffs тарифы duties пошлины quotas квоты

protectionist протекциони-

стские local subsidiary филиал

sole agents отдельные агенты

multi-distributors дистрибуторы

joint venture совместное предприятие, СП

Задание 7.2. Answer the questions:

1. What is international trade?

2. What is export?

3. What is import?

4. What are the measures to control international trade?

5. What is a tariff?

6. What is a quota?

7. What are the methods to establish products in a foreign market?

^Text 3

MARKETING MANAGEMENT

Management is a function of planning, organizing, coordinating, directing and controlling. Any managerial system, at any managerial level, is characterized in terms of these general functions.

Management is a variety of specific activities. Marketing management refers to a broad concept covering organization of production and sales of products, which is based on consumer requirements research. All companies try to look beyond their present situation and develop a long-term strategy to meet changing conditions in their industry. Marketing management, therefore, consists of evaluating market opportunities, selecting markets, developing market strategies, planning marketing tactics and controlling marketing results.

Strategic planning includes defining the company’s long-term objectives as well as specific objectives, such as sales volume, market share, profitability and innovation, and deciding on financial, material and other resources necessary to achieve those objectives.

|

|

|

© helpiks.su При использовании или копировании материалов прямая ссылка на сайт обязательна.

|