- Автоматизация

- Антропология

- Археология

- Архитектура

- Биология

- Ботаника

- Бухгалтерия

- Военная наука

- Генетика

- География

- Геология

- Демография

- Деревообработка

- Журналистика

- Зоология

- Изобретательство

- Информатика

- Искусство

- История

- Кинематография

- Компьютеризация

- Косметика

- Кулинария

- Культура

- Лексикология

- Лингвистика

- Литература

- Логика

- Маркетинг

- Математика

- Материаловедение

- Медицина

- Менеджмент

- Металлургия

- Метрология

- Механика

- Музыка

- Науковедение

- Образование

- Охрана Труда

- Педагогика

- Полиграфия

- Политология

- Право

- Предпринимательство

- Приборостроение

- Программирование

- Производство

- Промышленность

- Психология

- Радиосвязь

- Религия

- Риторика

- Социология

- Спорт

- Стандартизация

- Статистика

- Строительство

- Технологии

- Торговля

- Транспорт

- Фармакология

- Физика

- Физиология

- Философия

- Финансы

- Химия

- Хозяйство

- Черчение

- Экология

- Экономика

- Электроника

- Электротехника

- Энергетика

И.П. Агабекян, П.И. Коваленко 16 страница

Complementary goods

Goods that are often consumed together, like peanut butter and jelly, are complements.

If the price of peanut butter should increase, the quantity of peanut butter consumed will decrease. Since peanut butter and jelly are consumed together, the quantity of jelly demanded at each and every price will also decline, and the demand curve for jelly will shift in.

What are some other factors that might cause the demand to increase or decrease? How would these changes be reflected in the demand curve? The following is a brief list of factors that might affect the curve:

• Change in the environment.

• Change in the item’s usefulness.

• Change in income.

• Change in the price of a substitute product.

• Change in the price or availability of complementary products.

• Change in styles, taste, habits, etc.

If any of these events occurred, the demand schedule would change in such a way that the quantity demanded at any particular price would be higher or lower.

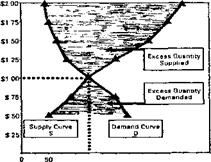

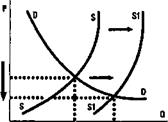

| Here is a chart of supply-demand curves. The point of their intersection is the market price.

|

<^Text 4 SUPPLY

Thus far we have only spoken about the effects of prices on buyers. But it takes two parties to make a sale: buyers and sellers. To the economist, supply refers to the number of items that sellers will offer for sale at different prices at a particular time and place.

The Law of Supply

The law of supply states that sellers will offer more of a product at a higher price and less at a lower price.

Why does the quantity of a product supplied change if its price rises or falls? The answer is that producers

supply things to make a profit. The higher the price, the greater the incentive to produce and sell the product.

Changes in Supply

When supply changes, the entire supply curve shifts either to the right or to the left. This is simply another way of saying that sellers will be offering either more (if supply has increased) or less (if supply has decreased) of an item at every possible price. Any or all of the following changes are likely to affect the quantities supplied:

— Changes in the cost of production. If it costs sellers less to produce their products, they will be able to offer more of them for sale. An increase in production costs will have the opposite effect — supply will decrease.

— Other profit opportunities. Most producers can make more than one product. If the price of a product they have not been producing (but could if they choose to) increases, many will shift their output to that product.

— Future expectations. If producers expect prices to increase in the future, they may increase their production now to be in position to profit later. Similarly, if prices are expected to decline in the future, producers may reduce production, and supply will fall.

Equilibrium

Supply and demand schedules tell us how many items buyers would purchase and how many items sellers would offer at different prices. By themselves they do not tell us at what price goods or services would actually change hands. When the two forces are brought together, however, something quite significant takes place. The interaction of supply and demand will result in the establishment of an equilibrium or market price.

The market price is the one at which goods or services will actually be exchanged for money. The price at which supply exactly equals demand is known as the market price, or the point of equilibrium.

Perfect Competition Conditions

The market price is the only price that can exist for any length of time under perfect competition conditions. Perfect competion exists when the following conditions prevail:

— Buyers and sellers have full knowledge of the prices quoted in the market.

— There are many buyers and sellers so that no individual or group can control prices.

— The products are identical with one another. Therefore, it would not make sense for buyers to pay more than the market price, nor for sellers to accept less.

— Buyers and sellers are free to enter or leave the market at will.

But why is the equilibrium price the only one that can exist for any length of time? The reason is: Because of Excess Quantity Demanded or Excess Quantity Supplied.

The process of changes of demand and supply would continue until the quantity supplied exactly equaled the quantity demanded.

We may conclude that an excess quantity supplied will result in price decreases until a new equilibrium is reached.

Equilibrium Price and Quantity

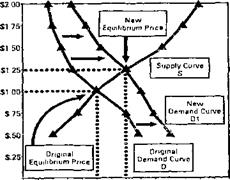

As long as supply and demand remain unchanged, the equilibrium or market price will remain constant.

|

|

^Text 4 SUPPLY, DEMAND AND MARKET PRICE

Summary

Market economies are directed by prices. As the price of an item rises, sellers are encouraged to increase production, and consumers are discouraged from purchasing the item. When the price falls, the opposite is true. In this way prices send out «signals» to buyers and sellers, keeping the economy responsive to the forces of supply and demand.

In a free market economy, prices are determined by the interaction of the forces of supply and demand. Perfectly competitive markets are those in which many buyers and sellers, with full knowledge of market conditions, buy and sell products that are identical to one another.

Demand is the quantity of goods or services that buyers would purchase at all possible prices. Demand varies inversely with price. That is, at a higher price fewer items would be bought than at a lower one. The degree to which price changes affect demand will depend upon the elasticity of demand for a particular item.

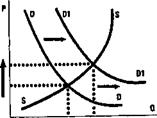

| \D1 V | Is |

| \—\ | |

| D • ^к | |

| % • | чС* 7 Q |

A decrease in demand will result in a decrease in the market price.

|

|

An increase in demand will result in an increase in the market price.

|

|

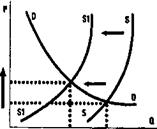

A decrease in supply will result in an increase in the market price.

|

|

An increase in supply will result in a decrease in the market price.

Supply, which is the quantity of goods or services that sellers would offer for sale at all possible prices at a particular time and place, varies directly with price. In

other words,-at a higher price, more goods and services will be offered for sale than at a lower one, and vice versa.

The price at which goods and services actually change hands is known as the equilibrium, or market price. It is the point at which the quantity demanded exactly equals the quantity supplied. Market price can be represented graphically as the point of intersection of the supply and demand curves.

Shifts in demand or supply will affect market price. When everything else is held constant, an increase in demand will result in an increase in market price, and vice versa. Similarly, an increase in supply will result in a decrease in price, and vice versa.

Vocabulary

to ration scarce resources — нормировать недостаточные ресурсы to motivate production — мотивировать производство rationing effect of prices — нормирующий эффект цен

level of output — уровень производства to encourage — поощрять production-motivating function of prices — мотивирующая производство функция цен to substitute for — заменять diminishing marginal utility

— уменьшение крайней полезности shape and slope — форма и наклон to triple — утроить have a relatively large effect

— иметь относительно большое влияние revenue test — тест на доходность item’s price — цена изделия shift — сдвиг, смещение peanut butter and jelly — арахисовое масло и желе complements - дополнения availability — зд. наличие occurred — имел место incentive — стимул expectations - ожидания to profit — получать прибыль to decline — снижаться actually — фактически point of equilibrium — точка равновесия to prevail — преобладать inversely — обратно пропорционально

^^Задание 3.1. Give answers to the following questions:

1. What roles do prices play in a market economy?

2. What affects the demand for goods and services in a market economy?

3. What affects the supply of a particular good or service?

4. How do demand and supply interact to determine prices?

5. How do shifts in demand and supply affect prices?

Задание 3.2. Translate into Russian:

1. В экономике цены определяются взаимодействием сил спроса и предложения.

2. Совершенные конкурентные рынки — это те, где много покупателей и продавцов, с полным знанием конъюнктуры рынка, покупают и продают друг другу изделия, которые являются идентичными.

3. Спрос — это количество товаров или услуг, которые покупатели купили бы по всем возможным ценам.

4. Спрос изменяется обратно пропорционально с ценой, то есть, при более высокой цене меньшее количестве изделий было бы куплено, чем при более низкой.

5. Предложение — это количество товаров или услуг, которое продавцы предложили бы для продажи по всем возможным ценам в определенное время и место, и, которое изменяется непосредственно с ценой.

6. Большее количество товаров и услуг будет предлагаться для продажи по более высокой цене, чем по более низкой, и наоборот.

7. Цена, по которой фактически продаются товары и услуги, известна как равновесие, или рыночная цена. Это — точка, при которой требуемое количество точно равняется предложенному количеству.

LESSON 4

^Text 1 MONEY AND ITS FUNCTIONS

The main feature of money is its acceptance as the means of payment or medium of exchange. Nevertheless, money has other functions. It is a standard of value, a unit of account, a store of value and a standard of deferred payment.

The Medium of Exchange

Money, the medium of exchange, is used in one-half of almost all exchange. Workers work for money. People buy and sell goods in exchange for money. We accept money not to consume it directly but because it can subsequently be used to buy things we wish to consume. Money is the medium through which people exchange goods and services.

In barter economy there is no medium of exchange Goods are traded directly or swapped for other goods. In a barter economy, the seller and the buyer each must want something the other has to offer. Each person is simultaneously a seller and a buyer. There is a double coincidence of wants.

Trading is very expensive in a barter economy. People must spend a lot of time and effort finding others with whom they can make mutually satisfactory swaps. Since time and effort are scarce resources, a barter economy is wastefill.

Money is generally accepted in payment for goods, services, and debts and makes the trading process simpler and more efficient.

Other Functions of Money

Money can also serve as a standard of value. Society considers it convenient to use a monetary unit to determine relative costs of different goods and services. In this function money appears as the unit of account, is the unit in which prices are quoted and accounts are kept.

To be accepted in exchange, money has to be a store of value. Money is a store of value because it can be used to make purchases in the future.

Houses, stamp collections, and interest-bearing bank accounts all serve as stores of value. Since money pays no interest and its real purchasing power is eroded by inflation, there are almost certainly better ways to store value.

Finally, money serves as a standard of deferred payment or a unit of account over time. When you borrow, the amount to be repaid next year is measured in money value.

Different Kinds of Money

Golden coins are the examples of commodity money, because their gold content is a commodity.

A token money is a means of payment whose value or purchasing power as money greatly exceeds its cost of production or value in uses other than as money.

A $10 note is worth far more as money than as a 3x6 inch piece of high-quality paper. Similarly, the monetary value of most coins exceeds the amount you would get by melting them down and selling off the metals they contain. By collectively agreeing to use token money, society economizes on the scarce resources required to produce money as a medium of exchange. Since the manufacturing costs are tiny, why doesn’t everyone make $10 notes?The essential condition for the survival of token money is the restriction of the right to supply it. Private production is illegal.

Society enforces the use of token money by making it legal tender. The law says it must be accepted as a means of payment. In modem economies, token money is supplemented by IOU money.

An IOU money is a medium of exchange based on the debt of a private firm or individual.

A bank deposit is IOU money because it is a debt of the bank. When you have a bank deposit the bank owes you money. You can write a cheque to yourself or a third party and the bank is obliged to pay whenever the cheque is presented. Bank deposits are a medium of exchange because they are generally accepted as payment.

Vocabulary

the means of payment средство платежа medium of exchange средство обращения a standard of value мера стоимости a unit of account единица учета

a store of value средство сбережения (сохранения стоимости) a standard of deferred payment средство погашения долга

subsequently впоследствии a barter economy бартерная экономика to swap (to exchange, to barter) обменивать, менять

to hand over in exchange передать, вручить в обмен

a double coincidence of wants двойное совпадение потребностей a monetary unit денежная единица to remind of напоминать to be worthless обесцениваться

an interest-bearing bank account счет в банке с выплатой процентов to pay interest приносить процентный доход to erode зд. фактически уменьшаться hard currency твердая (конвертируемая) валюта soft currency неконвертируемая валюта invariably неизменно, постоянно

commodity money деьыи — товар

token money символические деньги (дензнаки, жетоны, и т.п.) to melt down расплавить tiny costs мизерные затраты to supplement дополнять

legal tender законное платежное средство IOU money (I Owe You-я вам должен) деньги — долговое обязательство a bank deposit вклад в банке

Задание 4.1. Give Russian equivalents to the following:

1. exchange labour services for money

2. you must hand over in exchange a good or service

3. a double coincidence of wants

4. spend a lot of time and effor

5. make mutually satisfactory swap

6. a barter economy is wasteful;

7. commodity generally accepted in payment for goods

8. prices are quoted and accounts are kept

9. its purchasing power is eroded by inflation

10. it’s usually but not invariably convenient

11. cut back on other uses

12. exceeds its cost of production

13. by collectively agreeing

14. the survival of token money

15. society enforces the use of token money

16. token money is supplemented by IOU money

17. interest-bearing bank accounts

®^3адание 4.2. Replace the words in italics by synonyms:

sometimes payment can be put off till later,

the vital feature of money;

its purchasing power is worn away,

the money is without value,

it is not always convenient;

time and effort are rare resources;

private production of money is against the law

^^Задание 4.3. Find in the text English equivalents for the following

1. средство платежа

2. средство обращения

3. мера стоимости

4. средство сбережения (средство сохранения стоимости)

5. единица учета

6. средство погашения долга

7. в обмен на

8. может быть впоследствии использовано

9. обмениваться товарами и услугами

10. бартерная экономика

11. измеряться

12. обесцененный

13. платить проценты

14. покупательная способность

15. промышленное использование

16. потребительское использование

17. деньги — товар

18. денежные знаки (символические деньги)

19. денежная стоимость

20. ограничение права

21. вклад в банке

22. банковская ссуда

23. законное платежное средство

24. долговое обязательство

^"Задание 4.4. Answer the questions:

1. Why do people accept money?

2. What are the functions of money?

3. What are different kinds of money?

4. What’s a barter economy?

5. What does IOU stand for?

Задание 4.5. Translate into English:

Существует несколько функций денег. Во-первых и прежде всего, деньги являются средством платежа, или обращения; деньги можно использовать при покупке и продаже товаров и услуг. Деньги выступают также мерой стоимости. Общество считает удобным использовать денежную единицу в качестве масштаба для соизмерения относительных стоимостей различных благ и ресурсов.

Деньги служат средством сбережения. Поскольку деньги являются наиболее ликвидным товаром, то есть таким, который можно без проблем продать (обменять), то они являются очень удобной формой хранения богатства. Это, однако, не единственная форма хранения богатства. Во время упадка в экономике, при высокой инфляции и обесценении денег, население, скорее всего, будет хранить богатство в виде недвижимости или других дорогостоящих товаров — предметах искусства, драгоценностях.

Деньги, которые, являются долговыми обязательствами государства, коммерческих банков и сберегательных учреждений, имеют стоимость благодаря товарам и услугам, которые приобретаются за них на рынке.

^"Задание 4.6. Translate the text using a dictionary.

^Text 2

MONEY AS A MEDIUM OF EXCHANGE

Money is a medium of exchange in economy. It is a means of payment for goods and services and in settlement .■f debts. Money is also a standard of value for measuring the relative economic worth of different goods and services. The price of the commodity is the number of units of money required to buy this commodity. The main functions of money are a medium of exchange and the measure of value. Without the use of money, trade would be reduced to barter, that is to direct exchange of one commodity for another. Barter trade was the means used by primitive peoples, and it is still practised in some parts of the world. In a barter economy, a person having something to trade must find another who wants it and has something acceptable to offer in exchange. In a money economy, the owner of a commodity may sell it for money and buy anything he wants for this money. So money may be regarded as a keystone of modern economic life.

Types of Money

The most important types of money are commodity money, credit money, and fiat money. The value of commodity money is about equal to the value of tl>e material contained in it. The principal materials used for this type of money have been gold, silver, and copper. Credit money are documents with promises by the issuer to pay an equivalent value in the standard monetary metal. Fiat money is paper money the value of which is fixed by government. Most minor coins in circulation are also a form of fiat money, because the value of the material of which they are made is usually less than their value as money.

Both the fiat and credit forms of money are generally made acceptable through a government decree that all creditors must take the money in settlement of debts. Fiat money in the form of banknotes is referred to as legal tender.

Banknotes are usually made from special high-quality paper, with watermarks, metallic strips, and other features against forgery. Highly sophisticated printing techniques are used, and banknote designs have elements that are hard to copy. Fronts and backs of notes are printed separately, and serial numbers are added later.

LESSON 5

^Text 1 THE SOURCES OF INCOME

Before people can consume anything, however, they must do two things. First they must earn the income to buy the things they want. Then they must decide how the money will be spent. There are two ways to earn income: from work and from the use of wealth.

Income From Work

Most of the income comes from work. In return for working, people receive a wage or a salary. The term «wage» typically refers to the earnings of workers paid by the hour or unit of production. «Salary» refers to earnings paid on a weekly or monthly basis. How much you earn will depend on the kind of job, the abilities, the performance, and a number of other factors.

Income From Wealth.

Wealth can be expressed as the value of the things you own. Adding the value of all your possessions, bank accounts, savings, and the like will give you the total amount of your wealth.

Used in certain ways, wealth can earn income. If you owned a house, you might be able to let others use it for a fee. In that instance economists would say that you used your wealth to earn «rent.» Wealth, in the form of money that is loaned to others or deposited in a savings account, will earn interest. As you can see, interest and rent are two forms of income that can be earned by wealth.

Other types of income are dividends and capital gains that can be generated from the wealth.

Vocabulary

to consume - потреблять

earn the income — зарабатывать доход

earnings - заработки

dividends — дивиденды

capital gains — прирост капитальной стоимости

^^Задание 5.1. Give answers to the following questions:

1. What are two ways to earn income?

2. Who gets wages?

3. Who gets salaries?

4. What is wealth?

5. How can wealth earn income?

6. What is «rent»?

7. What is interest?

8. What are other types of income?

^Text 2 WHERE DO PEOPLE PUT THEIR SAVINGS IN THE UNITED STATES?

Most of the nation’s personal savings are held by the commercial banks, different types of savings institutions, and credit unions. The deposits held by these institutions are insured by agencies of the federal government. Savings institutions offer one or more of the following kinds of accounts:

• Passbook and statement savings accounts. The safety of your money and high liquidity are the most important advantages of these accounts. Minimum balance requirements are usually quite low, and your savings can be withdrawn at any time The disadvantage of passbook and statement savings accounts, however, is that they pay relatively low interest rates.

• NOW (Negotiable Order of Withdrawal) accounts. NOW accounts pay interest and allow the depositor to write checks. NOW accounts generally offer a slightly lower rate of return than savings accounts.

• Money-market accounts. These insured accounts allow you to write a limited number of checks while participating in the «money market» where banks and other businesses buy and sell short-term credit instruments, notes and other kinds of IOU’s that come due in a year or less. The rate of return for money market accounts is usually higher than for passbook savings accounts.

• Certificates of deposit. Certificates of deposit, or CD’s, pay the highest rates of interest offered by banks and savings institutions. They require the money to be left on deposit for a specified period of time that can run from a few weeks to five or more years. The money can be withdrawn early, if necessary, but not without a penalty.

• Credit-union accounts. Credit unions, associations of people with some thing in common, often serve people who have the same employer, work in the same industry, or belong to a particular church, labor union, or club. Credit unions offer insured savings plans similar to those offered by other savings institutions. In most instances, however, the rate of return offered by credit unions is higher than that of the other institutions.

• US savings bonds. U S savings bonds can be purchased at most savings institutions. Guaranteed by the United States government, they are one of the safest investments one can make. Since 1986 the bonds pay no less than 6 percent interest when held for five years. After five years bonds earn a variable rate adjusted every six months.

• Money-market funds. Money market funds use the resources of their investors to buy money-market certificates. Money-market funds generally pay a higher rate of return than savings and NOW accounts. Unlike other accounts at savings institutions, money-market fund accounts are not insured nor do they provide check- writing privileges.

Vocabulary

savings institutions сберегательные учреждения passbook and statement savings accounts сберкнижка и сберегательные счета

Negotiable Order of Withdrawal текущий счет, приносящий доход money-market accounts счета денежного рынка short-term credit instruments документы краткосрочного кредита

rate of return ставка дохода come due зд. подлежат оплате

certificates of deposit свободные обращающиеся депо- зитивные сертификаты penalty штраф, пеня credit-union accounts счета общества взаимного кредита

US savings bonds сберегательные облигации США money-market funds фонды денежного рынка

Задание 5.2. Give answers to the following questions:

1. Where are personal savings held in the USA?

2. What are the types of savings accounts?

3. What savings accounts give the highest interest and offer the highest rate of return?

^Text 3 CONSUMER CREDIT

Consumer credit provides cash, goods, or services now, while spreading repayment into the future. In this way credit enables you to enjoy your purchase even before you have paid for it.

But there are two important things attached to every credit purchase: credit costs something, and the principal, the original amount borrowed, must be paid back. If you are thinking of borrowing money or buying something on credit, you will want to know how much that credit will cost you and whether or not you can afford it. Then you can look for the best terms.

The Finance Charge and the Annual Percentage Rate (APR).

Credit costs vary from one lender to another, so think before you sign anything. Federal law requires that the lender tell you the total finance charges and the annual percentage rate or APR.

The finance charge is the total amount you pay to use credit. It includes interest costs and any other fees (such as service charges and insurance) that the seller or lender may be entitled to add to the loan.

The annual percentage rate, or APR, is the cost of credit calculated as a percent on an annual basis. For example, if someone lends you money at «only» 2.5 percent per month, the APR would be 30 percent (because 2.5 x 12 months = 30 percent).

Assume that a person borrowed $1000 at 10 percent interest. He agreed to pay the principal and interest back in 10 monthly installments. Calculate the APR with the following formula:

aрр = 2 x m_x ch ,

P(n+1)

m is the number of payment periods per year (12 if the payments are made monthly; 52 if made weekly).

ch is the carrying charge or interest (the cost of the loan beyond the amount borrowed).

P is the principal (the amount borrowed).

n is the actual number of payments made.

T 11 • 2 x 12 x $100

In this case: $10„0(J+1) -28%.

<^Text 4 OBTAINING AND USING CREDIT

Credit is an arrangement that enables us to receive cash, goods or services now, with the understanding that we will pay for them in the future. Charge accounts, credit cards, installment plans, car loans and household mortgages are some of the best known forms of credit. Like so many things, credit has its advantages and disadvantages.

The principal advantages of credit are:

• Immediate possession. Credit enables us to enjoy goods and services immediately.

• Flexibility. Credit allows us to time our purchases so as to take advantage of sale items or other bargains even when our funds are low.

|

|

|

© helpiks.su При использовании или копировании материалов прямая ссылка на сайт обязательна.

|