- Автоматизация

- Антропология

- Археология

- Архитектура

- Биология

- Ботаника

- Бухгалтерия

- Военная наука

- Генетика

- География

- Геология

- Демография

- Деревообработка

- Журналистика

- Зоология

- Изобретательство

- Информатика

- Искусство

- История

- Кинематография

- Компьютеризация

- Косметика

- Кулинария

- Культура

- Лексикология

- Лингвистика

- Литература

- Логика

- Маркетинг

- Математика

- Материаловедение

- Медицина

- Менеджмент

- Металлургия

- Метрология

- Механика

- Музыка

- Науковедение

- Образование

- Охрана Труда

- Педагогика

- Полиграфия

- Политология

- Право

- Предпринимательство

- Приборостроение

- Программирование

- Производство

- Промышленность

- Психология

- Радиосвязь

- Религия

- Риторика

- Социология

- Спорт

- Стандартизация

- Статистика

- Строительство

- Технологии

- Торговля

- Транспорт

- Фармакология

- Физика

- Физиология

- Философия

- Финансы

- Химия

- Хозяйство

- Черчение

- Экология

- Экономика

- Электроника

- Электротехника

- Энергетика

Heckscher-Ohlin Trade Model. Part 2: Winners and Losers.

Heckscher-Ohlin Trade Model. Part 2: Winners and Losers.

Any change in economic policy will have winners and losers. Change provides opportunity but also adversely affects those whose interests are to maintain the status quo. Opening up to international trade is a dramatic change in policy. In the presentation of the Heckscher-Ohlin model, we glibly moved along Mexico's and the US's PPFs. But, moving from one point to another along a PPF is neither instantaneous nor painless. There are short-term adjustments as the import-competing industry suffers losses resulting in bankruptcies and unemployment. The decline of this industry is an obvious short-term cost. Over the course of time, labor is reabsorbed into the workplace. Capital is reinvested. And, as we saw above, the country as a whole is better off. But, a closer analysis will show that even in the long run, after this readjustment takes place, there are still those who stand to lose.

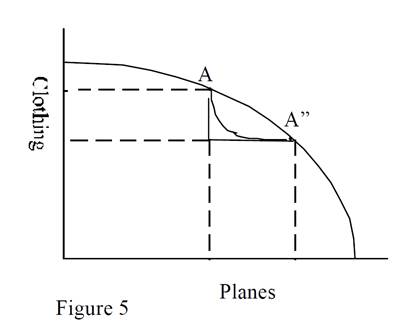

The United States, after opening up to trade, specialized in its comparative advantage by shifting production from the clothing to the plane industry. The actual time path between points A and A" is not along the surface of the PPF. The importation of Mexican clothing drove the relative price of clothing downwards. US clothing manufacturers who became uncompetitive due to higher opportunity costs had to shut down. This creates pockets of unemployment centered in cities and towns who played home to the US clothing industry. As the factories shut down, so did many small businesses. Life for those affected is difficult. But, over the course of time people move seeking jobs where employment possibilities exist, the cities and towns where planes are produced. As export demand for planes rises, so does the demand for labor. After a while readjustment finishes with the US producing at A".

In Figure 5, the time path described above would follow the curved line under the PPF between A and A". We see an initial decrease in clothing production followed by an increase in plane production.

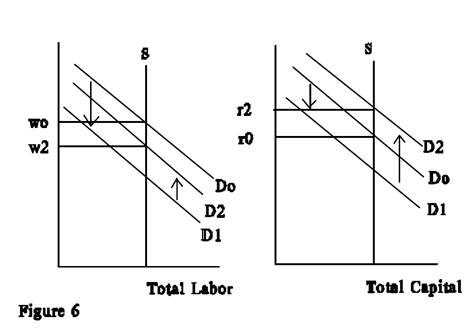

We need to examine the effects of these changes in production on input prices. Thus an examination of input markets is necessary. These markets of course are made up of the demand and supply for labor and capital. The demand for an input changes with changes in production. One thing to note though is that moving from one point to another along a PPF does not change the total amount of resources available. This is illustrated by vertical supply curves for labor and capital at the country's endowment (Figure 6).

Initially, clothing production decreases. This results in a decrease in the demands for labor and capital. But, if you recall, clothing production is labor intensive. Therefore the decrease in the demand for labor will be larger than the decrease in the demand for capital. This is shown in Figure 6 as the downward shifts in the demand curves from D0 to D1. Note that for labor the downward shift is larger. This puts a downward pressure on both wages (w) and the rental rate on capital (r). Initially, before trade the wage rate is w0 and the rental rate on capital r0.

Now plane production increases. The demands for labor and capital now both increase. But plane production is capital intensive, and this time the demand for capital will rise by more than the demand for labor. This is shown by upward shifts from D1 to D2. With this increase in the demands for labor and capital there is an upward pressure on input prices. After the adjustment process, wages fall to the equilibrium wage at w2 and the rental rate rises to the equilibrium rental rate at r2. Since w0 > w2, labor's wage falls. But, the price paid to capital rises, i.e., r2 > r0. Labor loses and capital owners win.

This result can be generalized into the Stopler-Samuelson Theorem. That is, if the relative price of a commodity increases, then the price paid to the input used intensively in its production will also rise, but the price paid to the other input will fall. This is illustrated in the above example where the relative price of the capital intensive good rose, P* > Pa, leading to higher rental rates on capital but lower wages.

The Ricardian model and Heckscher-Ohlin model are two basic models of trade and production. They provide the pillars upon which much of pure theory of international trade rests.

| Factor Price Equalization Theorem (Samuelson, 1949) Suppose that two countries are engaged in free trade, having identical technologies but different factor endowments. If both countries produce both goods, then the factor prices (w, r) are equalized across the countries. |

| Stolper-Samuelson Theorem An increase in the relative price of a good will increase the real return to the factor used intensively in that good, and reduce the real return to the other factor. |

HECKSCHER, OHLIN, AND THE LEONTIEF PARADOX

Wassily Leontief challenged the widely accepted Heckscher-Ohlin theory in 1954. Using a method of input-output analysis that he had invented, he measured the amount of labour and capital used in the production of the goods exported from, and imported to, the US. He determined, for example, the amount of labour required:

to produce a car;

to produce the steel, that went into the car;

to produce the coal, that fired the steel plant, that produced the steel, that went into the car;

… and so on.

Based on the Heckscher-Ohlin theory he expected that, because the US was the most capital-abundant country in the world when measured by the stock of machinery, buildings and other capital goods per worker, its exports would be capital-intensive and its imports labour-intensive.

He found the opposite.

For more than 50 years, economists have struggled to resolve this so-called Leontief paradox. Leontief speculated that the US might be labour-abundant if instead of simply measuring the quantity of employees we include cultural and organizational factors that support a high level of effective work per employee. While his hypothesis has not yet been adequately tested empirically, it reminds us that culture and institutions may be an essential part of explaining how an economy works. Some recent research is consistent (совместимый, согласующийся с) with Leontief's conjecture (предположение) and shows that his paradox holds in many countries.

Recent research on the Leontief paradox:

1. Helpman, Elhanan. 1999. ‘The Structure of Foreign Trade.’ Journal of Economic Perspectives 13 (2): 121–44.

2. Trefler, Daniel. 1995. ‘The Case of the Missing Trade and Other Mysteries.’ The American Economic Review 85 (5): 1029–46.

| Leontief paradox The unexpected finding by Wassily Leontief that exports from the US were labour-intensive and its imports capital-intensive, a result that contradicts what the economic theories of Leontief's day predicted: namely that a country abundant in capital (like the US) would export goods that used a large quantity of capital in their production. |

Rybczynski Theorem

Another item closely linked to the Heckscher-Ohlin theory is the Rybczynski Theorem (1955) asserting that an increase in a factor endowment will increase the output of the industry using it intensively, and reduce the output of the other industry.

An often cited example for applying this theorem is the so called “Dutch Disease”. It was observed that the discovery of oil off the coast of the Netherlands had led to an increase in industries making use of this resource and a decrease in other traditional export industries.

| The Rybczynski theorem predicts that for a small open economy, the increase in the resource would encourage the industry which uses the resource intensively and reduce the other industry, with all the other conditions fixed. |

|

|

|

© helpiks.su При использовании или копировании материалов прямая ссылка на сайт обязательна.

|