- Автоматизация

- Антропология

- Археология

- Архитектура

- Биология

- Ботаника

- Бухгалтерия

- Военная наука

- Генетика

- География

- Геология

- Демография

- Деревообработка

- Журналистика

- Зоология

- Изобретательство

- Информатика

- Искусство

- История

- Кинематография

- Компьютеризация

- Косметика

- Кулинария

- Культура

- Лексикология

- Лингвистика

- Литература

- Логика

- Маркетинг

- Математика

- Материаловедение

- Медицина

- Менеджмент

- Металлургия

- Метрология

- Механика

- Музыка

- Науковедение

- Образование

- Охрана Труда

- Педагогика

- Полиграфия

- Политология

- Право

- Предпринимательство

- Приборостроение

- Программирование

- Производство

- Промышленность

- Психология

- Радиосвязь

- Религия

- Риторика

- Социология

- Спорт

- Стандартизация

- Статистика

- Строительство

- Технологии

- Торговля

- Транспорт

- Фармакология

- Физика

- Физиология

- Философия

- Финансы

- Химия

- Хозяйство

- Черчение

- Экология

- Экономика

- Электроника

- Электротехника

- Энергетика

Answer.. 2.4 Problem IV

Answer.

(a) The general formula for a portfolio of two securities is

Vα r (α ra + (1 − α ) rb) = α 2σ 2a+ (1 − α )2σ 2b + 2α (1 − α ) ρ abσ aσ b.

If α = 0. 5 and securityα is a treasury bill, σ a = 0 and ρ ab = 0.

If security b is stock P then σ b = 0. 14.

We conclude

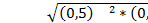

Vα r (α ra + (1 − α ) rb) = (0. 5)2 (0. 14)2 and the standard deviation is

σ =  =0, 07 or 7%

=0, 07 or 7%

(b) If α = 0. 5, securityα is stock Q, and security b is stock R then σ a = 0. 28, σ b = 0. 26.

1. If Q and R have perfect positive correlation then ρ ab = 1 then

Var (α ra + (1 − α ) rb) = (0. 5)2 (0. 28)2 + (0. 5)2 (0. 26)2 + 2 (0. 5)2* 1 * 0. 28 * 0. 26 = 0. 0729 and the standard deviation is

σ = √ 0. 0729 = 0. 279or 27%

2. If Q and R have perfect negative correlation then ρ ab = -1 then

Vаr(1/2 ra + 1/2 rb) ¶ = (0. 5)2 (0. 28)2 + (0. 5)2 (0. 26)2 − 2 (0. 5)2* 1 * 0. 28 * 0. 26 = 0. 0001 and the standard deviation is σ = √ 0. 0001 = 0. 01 or 1%

3. If Q and R have zero correlation then ρ ab = 0 then

V ar(1/2 ra + 1/2 rb) ¶ = (0. 5)2 (0. 28)2 + (0. 5)2 (0. 26)2 = 0. 0365 and the standard deviation is σ = √ 0. 0365 = 0. 19105 or 19, 1%

(c).

(d). No, because risk is measured by beta not by standard deviation. Beta measures non-diversifiable risk whilst standard deviation measures total risk. Investors are only compensated with a risk premium for holding non-diversifiable risk

2. 4 Problem IV

The task.

The information for Golden Fleece Financial is given in table 3.

Table 3 – The information for Golden Fleece Financial

| Long-term debt outstanding | $300, 000 |

| Current yield to maturity (rdebt) | 8% |

| Number of shares of common stock | 10, 000 |

| Price per share | $50 |

| Book value per share | $25 |

| Expected rate of return on stock (requity) | 15% |

Calculate Golden Fleece’s company cost of capital. Ignoretaxes.

Answer:

The total market value of outstanding debt is $300, 000. The cost of debt capitalis 8 percent.

For the common stock, the outstanding market value is: $50× 10, 000 = $500, 000.

The cost of equity capital is 15 percent.

Lorelei’s weighted-average cost of capital is:

rassets=( (300000/(300000+500000)*0, 08))+((500000/(300000+500000)*0, 15))

rassets= 0. 124 = 12. 4%

|

|

|

© helpiks.su При использовании или копировании материалов прямая ссылка на сайт обязательна.

|