- Автоматизация

- Антропология

- Археология

- Архитектура

- Биология

- Ботаника

- Бухгалтерия

- Военная наука

- Генетика

- География

- Геология

- Демография

- Деревообработка

- Журналистика

- Зоология

- Изобретательство

- Информатика

- Искусство

- История

- Кинематография

- Компьютеризация

- Косметика

- Кулинария

- Культура

- Лексикология

- Лингвистика

- Литература

- Логика

- Маркетинг

- Математика

- Материаловедение

- Медицина

- Менеджмент

- Металлургия

- Метрология

- Механика

- Музыка

- Науковедение

- Образование

- Охрана Труда

- Педагогика

- Полиграфия

- Политология

- Право

- Предпринимательство

- Приборостроение

- Программирование

- Производство

- Промышленность

- Психология

- Радиосвязь

- Религия

- Риторика

- Социология

- Спорт

- Стандартизация

- Статистика

- Строительство

- Технологии

- Торговля

- Транспорт

- Фармакология

- Физика

- Физиология

- Философия

- Финансы

- Химия

- Хозяйство

- Черчение

- Экология

- Экономика

- Электроника

- Электротехника

- Энергетика

Quinary Sector

Quinary Sector

Some economists further narrow the quaternary sector into the quinary sector, which includes the highest levels of decision-making in a society or economy. This sector includes top executives or officials in such fields as government, science, universities, nonprofits, health care, culture, and the media. It may also include police and fire departments, which are public services as opposed to for-profit enterprises.

Economists sometimes also include domestic activities (duties performed in the home by a family member or dependent) in the quinary sector. These activities, such as child care or housekeeping, are typically not measured by monetary amounts but contribute to the economy by providing services for free that would otherwise be paid for. An estimated 13.9% of U.S. workers are quinary sector employees.1

TASK :

Divide this examples of business to the sector

Breeding of sheep for wool, salt extraction, The petroleum industry, the fishery industry, dairy farming, horticulture, Road contractors, bag manufacturing industry, iron ore mines , Extracting LPG from natural gas, coal mines, the perfume industry, The salt processing unit, Construction of dams from bricks, cement, iron, Schools, hospitals, hotels, banks, mushroom plantation, medicine manufacturing, Mobile phones manufacturing, Sunflower farms.

2 ЧАСТЬ :

Types of Business

A person has first to select the kind of business line he wants to operate.

Thus, a business can be broadly classified as into the following types:

What type of business should you start?

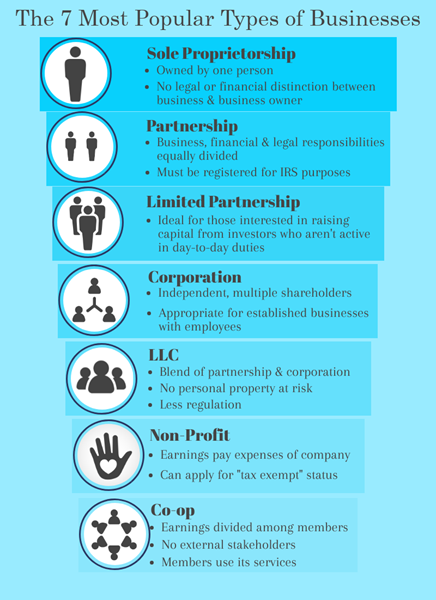

One of the first challenges new entrepreneurs face is deciding what type of business they should register. Although there are several different types of businesses, choosing one doesn't need to be difficult. Here are the seven most commonly-used business types and some questions to help you pick which business type is right for your startup:

Sole Proprietorship: The simplest type of business. Sole proprietorships are owned and operated by a single person and are very easy to set up.

Partnership: A business owned by two or more people who share responsibilities and profits.

Limited Partnership: A business partnership, often between business operators and investors.

Corporation: A type of fully-independent business with shareholders. One of the most complex business types.

Limited Liability Company (LLC): A mixture of a partnership and a corporation, designed to make it easier to start small businesses. One of the most popular business types for startups.

Nonprofit Organization: A type of business that uses its profits for charitable purposes. Tax-exempt, but must follow special rules.

Cooperative (Co-op): A business owned and operated for the benefit of the members of the organization that use its services.

Task!

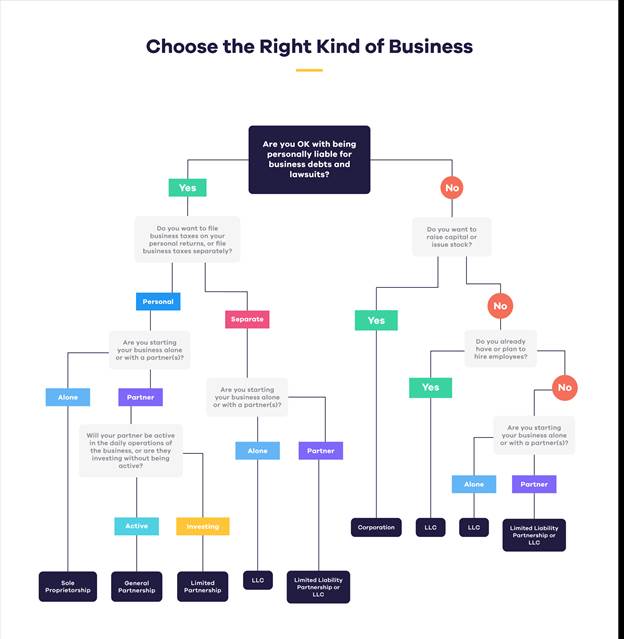

Choosing the right kind of business!

A startup's choice of business structure can have long-lasting effects on the way the business is run and operates, including how it files taxes and whether it can hire employees. To help your friend or relatives decide, this flowchart can help you to walk through the decision-making process:

Notes:

Decisions you'll need to make when choosing a business type:

Debt and Liability: Most small businesses and startups accept the personal liability associated with a sole proprietorship or partnership as a necessary risk of doing business. If you're in a high-risk industry (such as selling CBD or firearms online) or simply want to keep your business and personal matters private, you can limit personal liability by filing for a more formal business structure. The downside is that this typically takes more paperwork, costs more to register, and may have greater reporting or upkeep requirements than simpler business types.

Filing taxes: To oversimplify a bit, you have two options when it comes to filing your business taxes. You can file business profits/expenses on your own personal tax returns, or you can have your business file taxes separately as its own entity. Most small business owners prefer the simplicity of filing taxes on their own returns, but filing business taxes individually can help you keep your personal and business finances separate.

Partners or Investors: If you're starting your business with a partner or private investor, you won't be able to form a sole proprietorship. You can choose between a partnership (where all responsibilities and liability are shared equally), a limited partnership (which lets you dictate responsibilities and liabilities for individual members), or an LLC (to protect all members from personal liability).

Hiring employees: Some of the simplest business types—like sole proprietorships—can make it difficult to hire employees down the road. While it's possible to change your business type to grow with your business, if you already have employees or plan to hire employees, it may be better to future-proof with a more formal business structure like an LLC or corporation.

Are you starting your business for profit or to help a cause? If you're just concerned with helping others and aren't operating for profit, forming a nonprofit can grant you tax-exempt status—although there's a lot of paperwork required.

Will your company be owned and operated democratically by its members with no single owner? Known as a "Co-op", this type of business is rare.

After you've answered these questions and have decided which type of business is bes t for your startup, the next steps are dependent on your state and local laws and ordinances, as you may need to fill out additional forms specific to your location and type of business. There are a number of books and resources for this. Many of them recommend using the Small Business Association as the starting point since they maintain local offices. Finally, check your local and state laws regarding running a business out of your home, as zoning laws can sometimes be an important factor in deciding which type of business you want to create.

Most Popular Business Types

Sole Proprietorship

Sole proprietorships are the most common type of online business due to their simplicity and how easy they are to create. A sole proprietorship is a business owned and operated by a single person, and requires no registration. If you're operating a one-person business, you're automatically considered a sole proprietor by the government. However, depending on your products and location, you may need to register for local business permits with your city or state.

An important thing to note is that there isn't a legal or financial distinction between the business and the business owner. This means that you as the business owner are accountable for all of the profits, liabilities, and legal issues that your business may encounter—not typically an issue as long as you pay your bills and keep your business practices honest. If you're starting an ecommerce business by yourself, a sole proprietorship is probably the best type of business for you. If you're starting a business with one or more partners, keep reading!

Partnerships

Two heads are better than one, right? If you're starting your business with someone else, a partnership may be the right choice. A partnership offers many benefits—you can pool resources and knowledge with another, secure private funding, and more. Just keep in mind that within a partnership responsibilities and liability are split equally among each member. However, there are several types of partnerships (such as limited partnerships, discussed in the paragraph below) that will allow you to define the roles, responsibilities, and liability of each member.

A partnership does require that you register your business with your state and establish an official business name. After that, you'll be required to obtain a business license, along with any other documentation that your state office can help you with. Beyond that, you'll also need to register your business with the IRS for tax purposes. Although this may seem like a complicated process, there are lots of benefits to a partnership, so if you're looking to have a co-owner, don't be afraid to go for it—many online companies are formed using partnerships. Having someone to help share the work of starting a new business is definitely worth the extra paperwork.

Limited Partnership

A limited partnership, or LP, is an off-shoot version of a general partnership. While it may not be as common, it's a great bet for businesses who are looking to raise capital from investors who aren't interested in working the day-to-day aspects of your operations. With a limited partnership, there are two sets of partners: The General Partner and the Limited Partner. The general partner is usually involved in the everyday business decisions and has personal liability for the business. On the other hand, there's also a limited partner (typically an investor) who is not liable for debts and doesn't partake in regular business management of the company. Just like a general partnership, if you enter an limited partnership agreement, you'll need to register your business with the state, establish a business name, and inform the IRS of your new business. Again, this option is the most common for those looking for investment dollars, so keep that in mind Corporation

A corporation is a fully independent business that's made up of multiple shareholders who are provided with stock in a the business. Most common is what's known as a "C Corporation," which allows your business to deduct taxes much like an individual—the only problem with this is that your profits will be taxed twice, both at the corporate level and at the personal level. Don't let this fact deter you, however—this is extremely common, and if you currently work for a company with multiple employees, that's likely the business structure they're using. If you're starting off as a smaller business—particularly one that only operates online—declaring yourself as a corporation wouldn't be appropriate. However, if you're already an established business with several employees, listing your company as a corporation might be the correct move. You'll need to file very specific documents with the state, followed by obtaining the appropriate business licenses and permits.when exploring your partnership options.

Limited Liability Company (LLC)

Next on our list of business types is a Limited Liability Company, better known as an LLC. An LLC is a newer type of business that is a blend between a partnership and a corporation. Instead of shareholders, LLC owners are referred to as members. No matter how many members a particular LLC has, there must be a managing member who takes care of the daily business operations. The main difference between an LLC and a corporation is that LLCs aren't taxed as a separate business entity. Instead, all profits and losses are moved from the business to the LLC members, who report profits and losses on a personal federal tax return. The nice thing about pursuing an LLC is that members aren't personally liable for business decisions or actions of the company in question, and there's far less paperwork involved in creating an LLC as compared to a corporation. LLCs are another of the most common types of online businesses, since they allow small groups of people to easily form a company together.

Nonprofit Organization

A nonprofit organization is pretty self-explanatory, in that it's a business organization that's intended to promote educational or charitable purposes. The "non-profit" aspect comes into play in that any money earned by the company must be kept by the organization to pay for its expense, programs, etc. Keep in mind that there are several types of nonprofits available, many of which can receive "tax exempt" status. This process requires filing paperwork, including an application, with the government for them to recognize you as a nonprofit organization. Depending on the parameters of your new business, they'll be able to tell you which category you best fall under.

Cooperative

The last on our list is what's known a cooperative, or a business that's fully owned and operated for the benefit of the members of the organization that use its services. In other words, whatever is earned by the cooperative is then shared among the members themselves, and isn't required to be paid out to any external stakeholders, etc. Unlike other types of businesses that have shareholders, cooperatives sell shares to cooperative "members," who then have a say in the operations and direction of the cooperative itself. The main difference in the process of becoming a cooperative as opposed to the other types of businesses listed is that your organization must create bylaws, have a membership application, and have a board of directors with a charter member meeting. This is one of the least common types of online businesses, although online cooperatives do exist, such as the outdoor goods store REI.

What type of businesses organizations and their sectors are all these companies belong to?

Is this business a start up? Is it the case of an expansion of an existing business, or the take-over of an existing business? What competition does it face?

1) XYZ Consulting is a new company that provides expertise in search marketing solutions for businesses worldwide, including website promotion, online advertising, and search engine optimization techniques to improve its clients' positioning in search engines. We cater to the higher education market, including colleges, universities, and professional educational institutions.

2) Ann’s Office Hut delivers office supplies to small businesses in Boston, Massachusetts. The business is structured as a sole proprietorship, operating under entrepreneur Ann Smith. Ann’s Office Hut is located in Boston, Massachusetts and will begin operations in February. Ann’s Office Hut recognizes the busy lives of small business owners and wants to bring essential items like printers, cash registers, paper, ink, and envelopes to their doorsteps. Ann’s Office Hut will conveniently provide office supplies to small business owners who are short on time. Other office supply stores cannot match the convenience Ann’s Office Hut will give.

The business hopes to have gross sales of $30,000 by the end of one year and $95,000 by the end of five years. To achieve this goal, Ann’s Office Hut plans on offering referral credit.

|

|

|

© helpiks.su При использовании или копировании материалов прямая ссылка на сайт обязательна.

|